Investor Relations CRM

Designed and launched a purpose-built Investor Relationship Management platform — replacing fragmented workflows with a connected system for managing investor data, engagement signals, and leadership reporting. Teams reduced manual workarounds, improved meeting preparation, and gained confidence in critical information under pressure. Teams reduced prep time by 60%, replaced manual workarounds, and gained confidence in data during earnings calls, roadshows, and board meetings.

Context Setting

| Aspect | Details |

|---|---|

| Project Duration | December 2022 — June 2023 (6 months) |

| Team | Product Managers, Senior Designers, Engineering Leads, Backend & Frontend Engineers |

Our primary users were Investor Relations (IR) professionals, responsible for building and managing relationships with investors, analysts, and stakeholders. Their work is high-pressure, deadline-driven, and often mobile — unfolding in airports, hotel lobbies, and conference centers.

IR Managers

Maintaining investor relationships and prepping for earnings calls

Analysts

Handling ownership data, reporting, and ensuring accuracy under tight deadlines

Executives

Relying on IR teams for clear, reliable investor insights that shape market perception

Understanding the Problem Space

From the outside, Investor Relations looks polished:

Earnings Calls

Seamless, well-rehearsed

Investor Presentations

Confident, data-backed updates

Leadership Reports

Clear, high-level insights

But beneath the surface, teams are stitching it together with disconnected tools. IR teams manage complex relationships with investors, analysts, and stakeholders, often under tight deadlines and unpredictable conditions. Their work happens everywhere: airports, hotels, boardrooms, and conference centers.

They toggle between spreadsheets, email threads, CRM exports, notebooks, and half-functioning mobile apps - often minutes before critical meetings.

We noticed early signs of this across industries - healthcare, tech, industrials, and financial services - through informal conversations, product walkthroughs, and observations. Our Sales and Marketing teams flagged similar friction during demos and prospect calls. Buyers liked the idea of a connected IR workflow but were skeptical - they'd seen promises before, few tools delivered under real-world pressure.

We didn't need formal research to spot the cracks. Teams were duct-taping workflows from tools never built for how IR really works. We knew we couldn't design for the polished version of the work. We had to design for the messy reality: bad Wi-Fi, last-minute schedule changes, missing data, and constant pressure to be prepared.

That led to the deeper discovery work, where the real gaps came into focus.

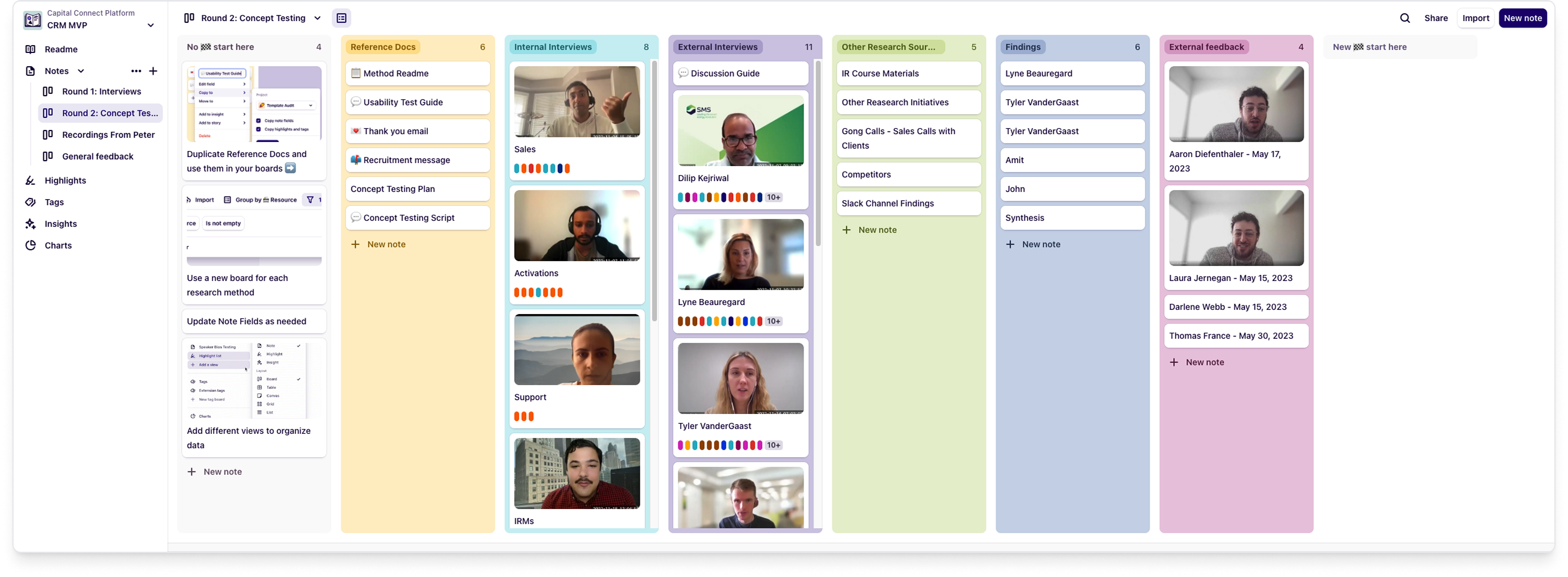

Immersive Discovery

We heard early from IR teams that this wasn’t about dashboards or shiny tools. It was about trust, prep, and survival tactics before high-stakes investor meetings. The tools they relied on? Scattered. Notes in inboxes, personal details scribbled in notebooks, ownership data buried in outdated spreadsheets.

We knew we had to dig deeper. Not assumptions, specifics. Our discovery focused on:

The Last 30 Minutes

What do teams scramble to pull together right before a meeting? Where does it break down?

Building Investor Trust

What personal context or history makes investor relationships stick?

Leadership Prep

How does management get briefed, and what gets missed?

The Company Story

How do teams adjust messaging when investors know the peers?

Recurring Investor Themes

How do teams track patterns in questions, interests, and concerns?

What We Actually Heard

- Teams flipped through old meeting notes to prep management, hunting for past conversations, investor priorities, and ownership details minutes before walking into meetings.

- Personal information mattered. Remembering investor values, relationship history, even small details shared months ago helped build credibility fast.

- Management involvement was tied to ownership. If investors held enough shares, leadership showed up — but only with reliable, quick summaries in hand.

- Peer ownership shaped messaging. Teams adjusted differentiators based on whether investors were already invested in competitors.

- Tracking recurring questions, investor themes, and meeting outcomes was manual. Notes were scraped together at quarter-end for reporting and board materials.

- Mobile tools collapsed in airports, hotels, and conference centers. Weak connections and unreliable apps meant teams defaulted to memory or paper backups.

Confidence eroded fast when systems couldn’t keep up. Teams defaulted to duct-taping workflows together, or showing up underprepared.

Even with CRMs like Salesforce or HubSpot, critical workflows were missing — IR teams stitched solutions together until they failed under pressure.

What Discovery Made Clear

We weren’t building for ideal conditions. We were designing for lobbies, airports, and boardrooms where:

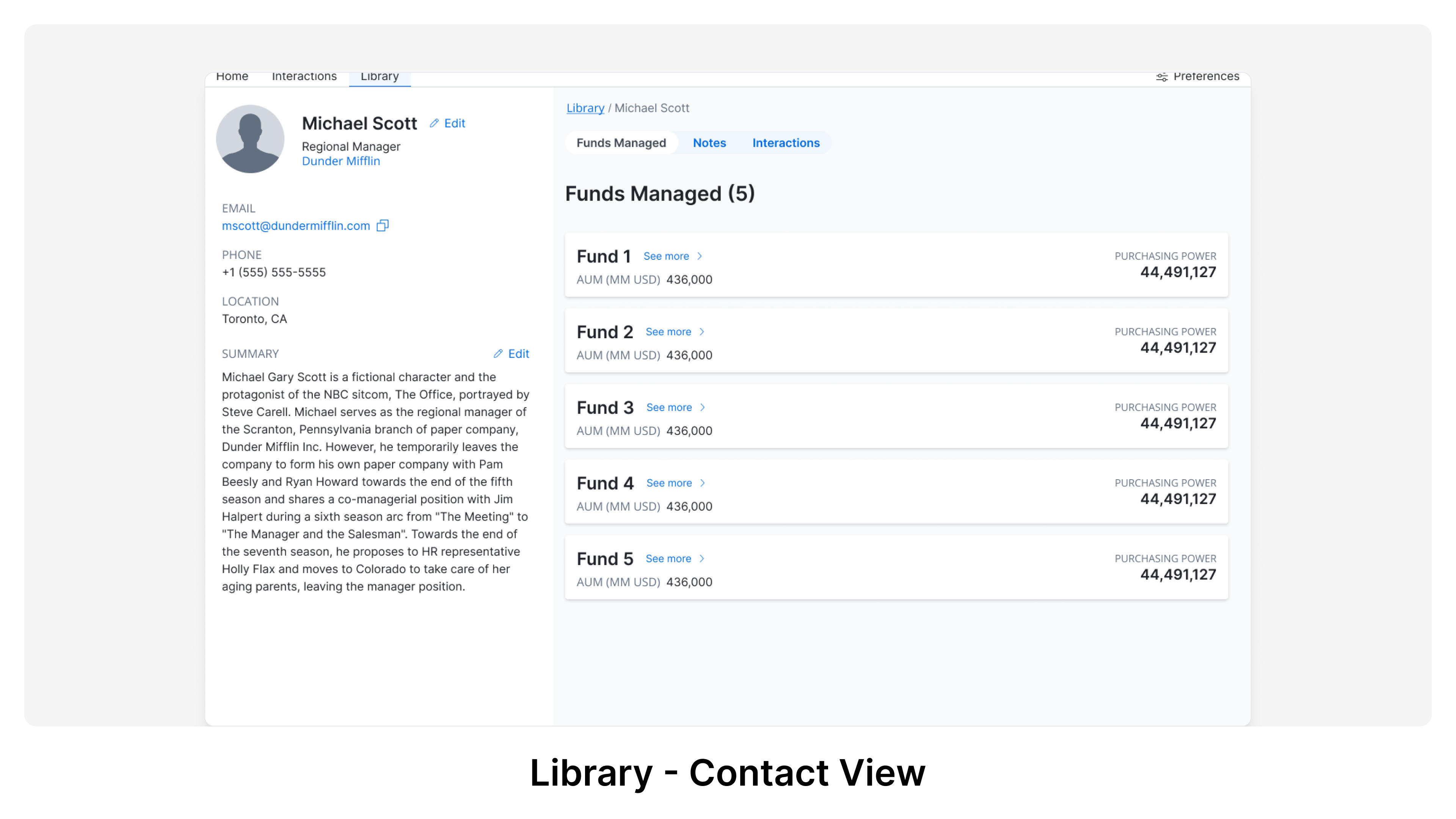

Profiles Work Hard

Investor history, ownership, engagement, and personal context live together.

Mobile Performs

Offline workflows that hold up under weak signals.

Management Is Ready

Quick, reliable briefing materials tailored to real stakes.

Signals Surface

Patterns in investor questions and concerns drive reporting.

The System Holds Up

It works under pressure, or it doesn't work at all.

Investor moments happen anywhere, often with no time to spare. If teams can’t rely on their system then, they can’t rely on it at all.

With that clarity, we started building and testing where it mattered most.

Building the First Version

We knew from discovery: this wasn’t about feature checklists. It was about fixing the frantic, fragmented prep IR teams described. Teams were flipping through notebooks minutes before meetings, piecing together ownership data from scattered sources, and relying on memory when mobile tools failed in the field.

We took a lean, targeted approach. Instead of overloading the system, we focused on core workflows that directly addressed what teams told us they struggled with.

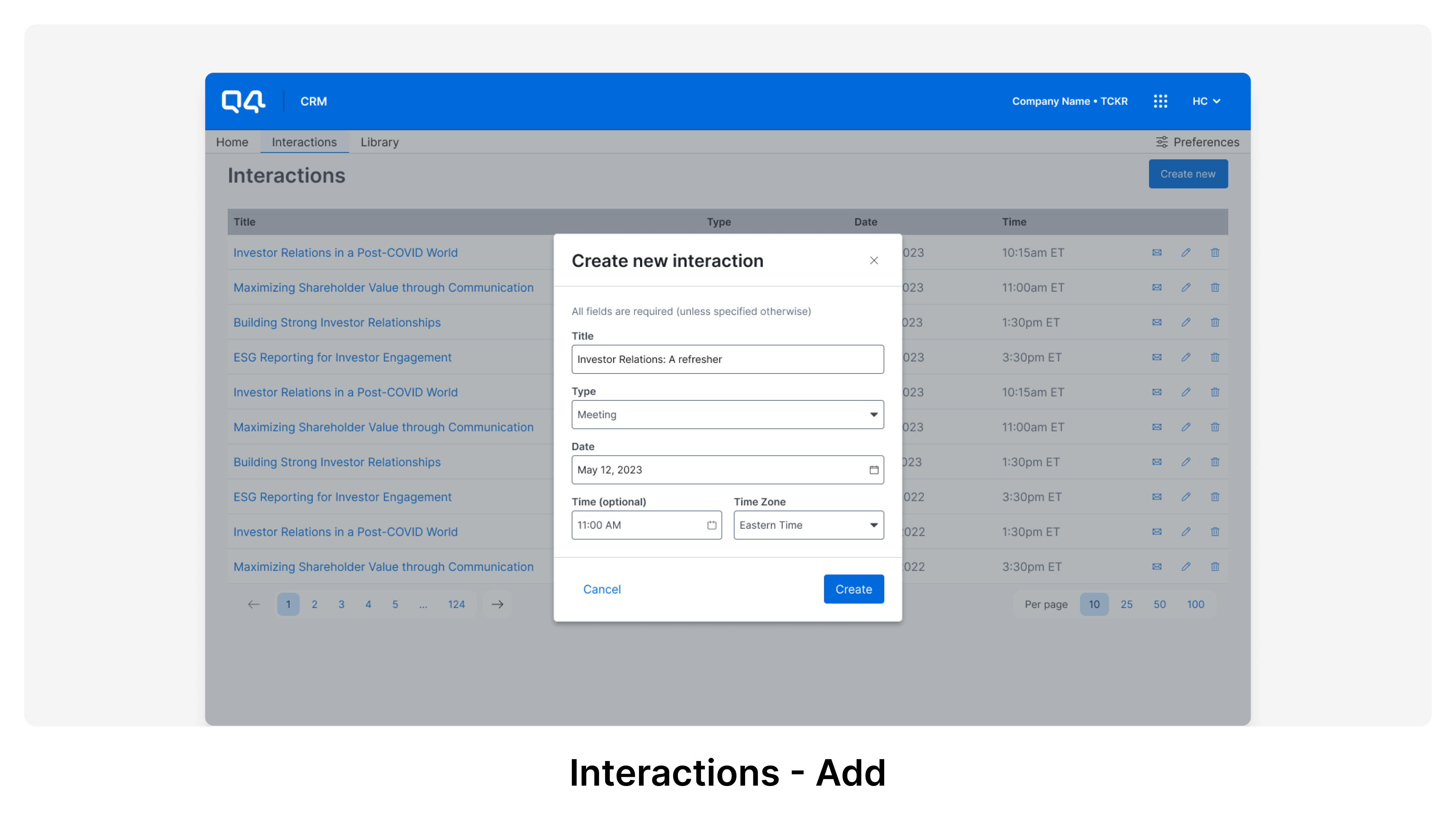

First Iteration

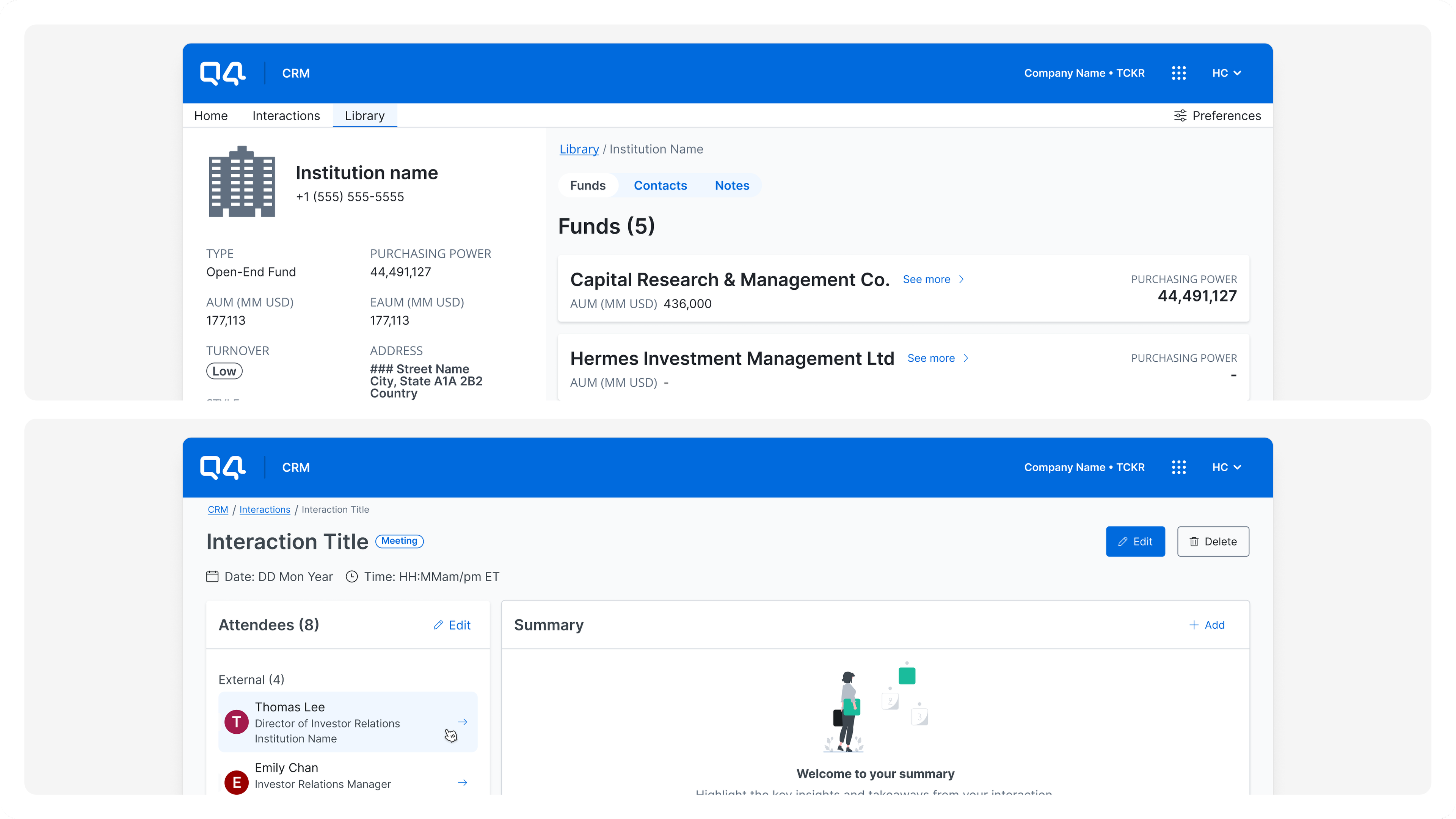

Investor Profiles

Searchable, customizable profiles tied to ownership, engagement, and historical notes — no more last-minute inbox dives or notebook flipping.

Engagement Signals

Website, event, and email activity feeding investor profiles to help teams prep fast and personalize outreach.

Outreach Pipelines

Tracks meetings, follow-ups, and relationship progress in one place — not across five tools.

Executive Reporting

Exportable reports tailored for leadership, with the right context to decide when management gets involved.

Basic Mobile

Light mobile experience to start validating real-world conditions, especially travel scenarios.

Gaps in the Initial Version

- Mobile broke down during travel — unreliable performance and poor offline support forced teams back to memory or paper.

- Investor profiles buried key ownership details teams needed quickly.

- Reports surfaced data but were cluttered, slowing leadership decision-making.

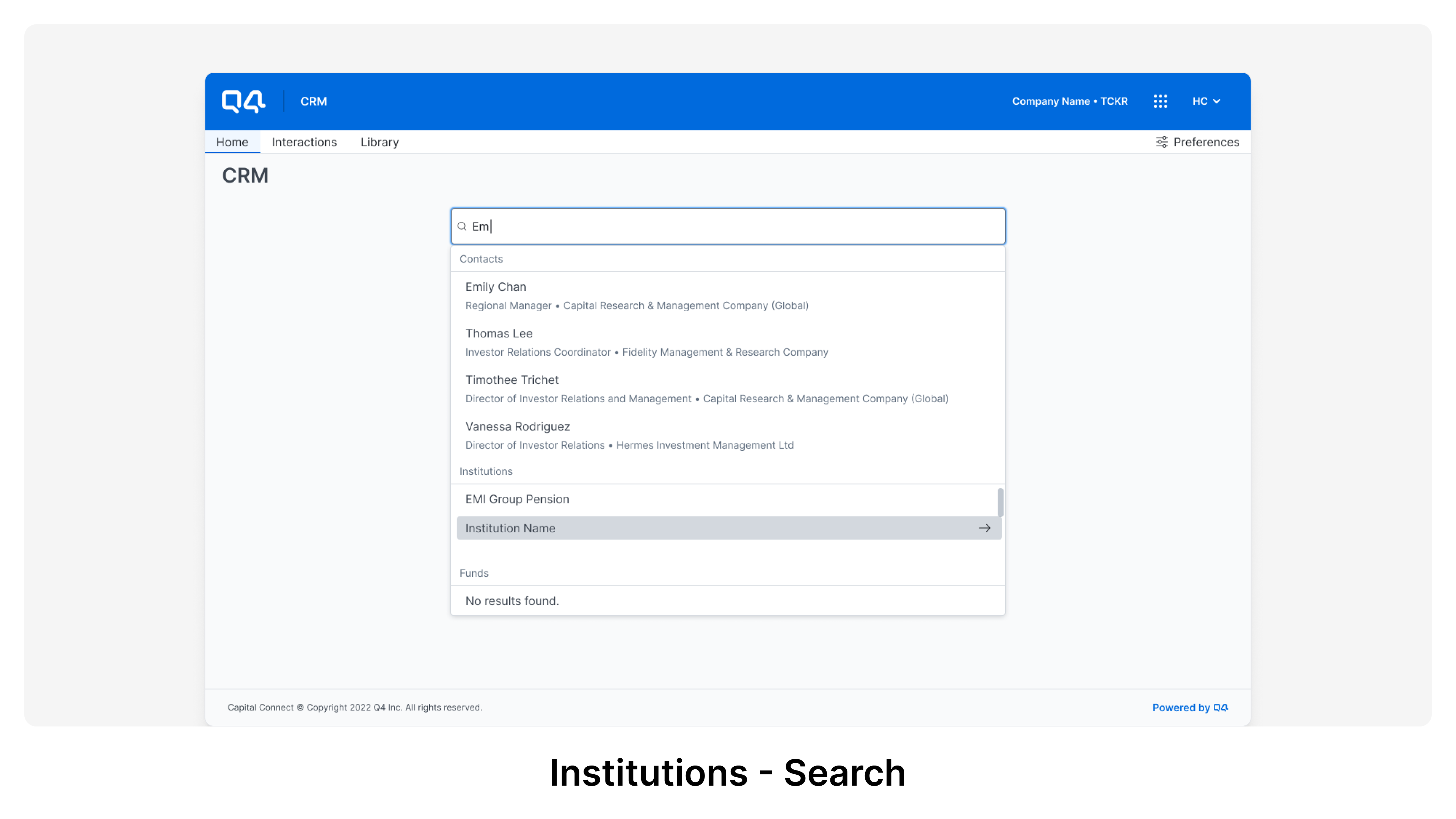

- Search couldn’t keep up under pressure — teams couldn’t surface contacts fast enough.

- Teams lacked control to clean and correct their data, undermining trust.

Testing and Iterations

We tested in real conditions: conferences, earnings cycles, and travel-heavy schedules. Field feedback was blunt — and we moved fast.

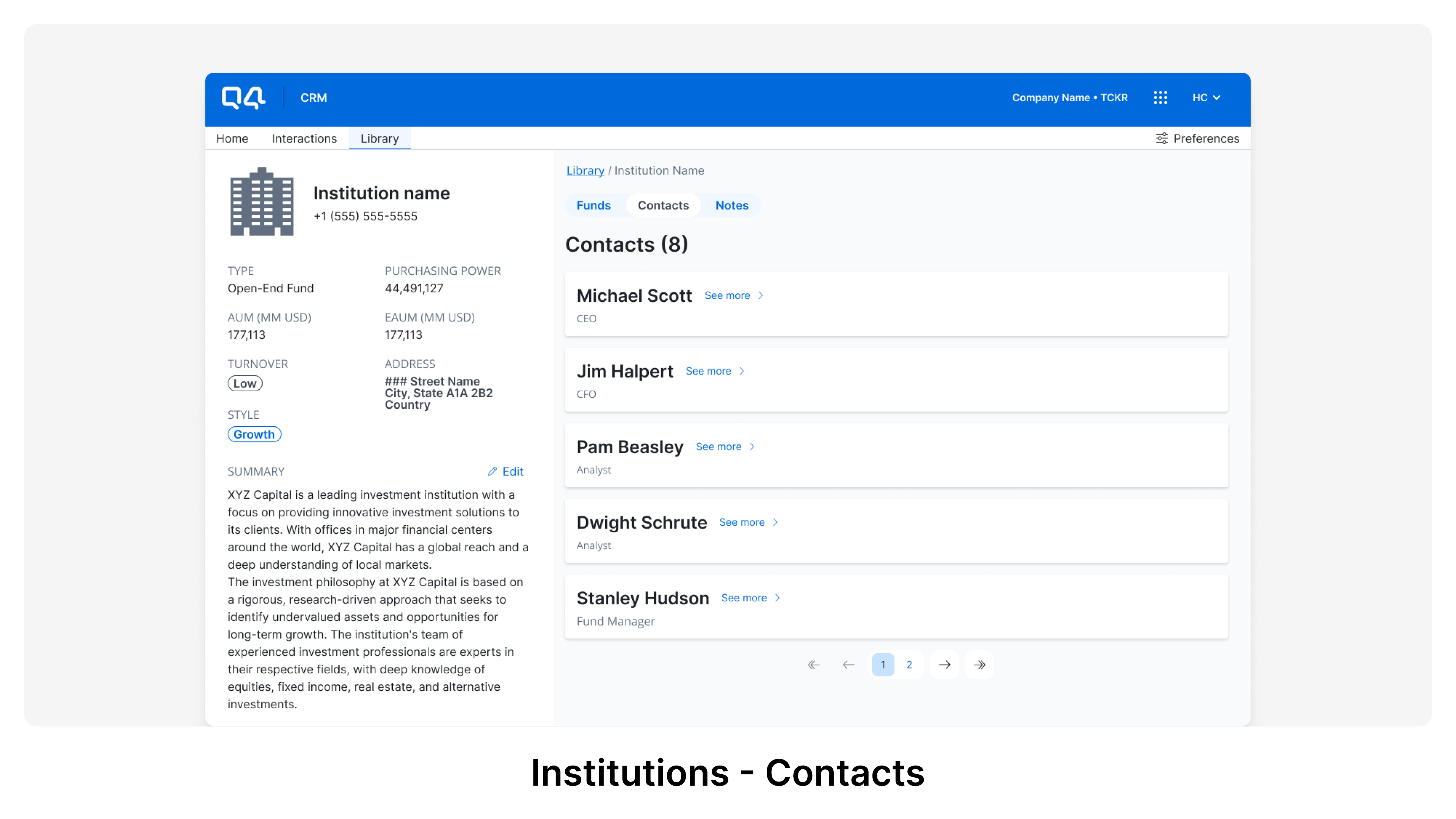

- Redesigned profiles so ownership and key investor context surfaced instantly.

- Rebuilt mobile for reliability — offline-tolerant, fast-loading, tested in weak-signal environments.

- Simplified reporting to focus on decision-ready insights for leadership.

- Tuned search to be near-instant under real conditions.

- Gave teams manual control over their data — building trust incrementally.

Product, design, and engineering worked tightly, trading complexity for reliability. We weren’t chasing feature depth; we prioritized earning trust, fixing field gaps, and stabilizing daily IR workflows.

What We Actually Shipped

Our MVP wasn’t flashy by design. It had to be reliable, practical, and built for teams navigating complex, high-pressure environments — often with weak Wi-Fi and no time to spare.

Delivery

Connected Investor Profiles

Ownership, history, engagement signals, and personal notes in one place — eliminating scattered prep.

Verified Engagement Data

Real-time, reliable insights directly tied to investor contacts.

Outreach Pipelines

Mirrored how teams already track meetings, follow-ups, and investor progress.

Executive-Ready Reporting

Fast, exportable reports with decision-focused insights for leadership.

Reliable Mobile Tools

Performance that holds up during travel — airports, hotels, and conference centers included.

Shared Team Visibility

Aligned workflows and shared notes so teams stay in sync.

Faster Briefing Prep

Streamlined briefing book creation, investor meeting prep, and earnings cycles.

The product replaced fragmented tools with one connected system — cutting last-minute scrambles, scattered emails, and duct-taped workflows.

The Impact

- Prep time for investor meetings shrank from days to hours.

- Teams replaced guesswork with real-time ownership and engagement insight.

- Data confidence improved, reducing friction across teams and leadership.

- Reliable mobile removed the need for paper backups or risky memory-based prep.

- Teams consolidated five-plus tools into one system.

- Executive reporting became proactive, with teams better prepared for high-stakes moments.

Every feature targeted real-world realities, reducing complexity and building trust — one reliable moment at a time.

What We Learned and What's Next

Search Must Be Instant

Critical contacts and ownership data have to surface fast, or teams default to memory.

Mobile Has to Work

IR work happens in airports, hotels, and conference centers. If mobile fails, teams scramble.

Simplicity Wins

Overloaded tools slow down already stressed teams. Simple, reliable workflows stick.

Context Builds Confidence

Data is only useful if surfaced meaningfully for prep and decision-making.

If We Started Over

- Prioritize mobile stability and search speed from day one.

- Keep user feedback loops live beyond MVP to catch breakdowns early.

- Integrate deeply across systems upfront, so IR data flows naturally.

- Bake in collaboration tools to reduce silos, especially under deadline stress.

We hesitated early to push back on feature demands. That complexity slowed us down. Next time, we protect system stability sooner, even if it means saying no.

Where We're Headed

The first version closed obvious gaps. But plenty of work is still ahead — the harder stuff, the pieces that take longer to get right:

- Improving how teams track investor sentiment and feedback across months, not just meeting to meeting.

- Giving leadership more context, faster, without relying on teams to manually prep summaries under pressure.

- Building deeper visibility into peer activity, so teams can adjust their story before an investor points out the gaps.

- Taking mobile beyond "functional" into truly resilient — ready for worst-case travel conditions, not just basic offline use.

- Reducing the grind around reporting, especially for recurring investor questions and themes.

We’re keeping the scope narrow and practical. Just what helps teams walk into investor conversations better prepared than they were last quarter.

Guest Pass System

How we turned outdated guest access workflows into a scalable, revenue-generating system for Condos and HOAs — designed to reduce friction, restore fairness, and help communities function like communities again.

Masonry Design System

Developed a robust design system to eliminate UI inconsistency, enhance team alignment, and significantly elevate product quality. Reduced design-engineering friction (60% fewer overrides), accelerated feature delivery, ensured brand consistency, and improved cross-team collaboration.